LifeStage is an employee benefit. It can be funded through your employees by salary sacrifice or, as an employer, you can fund it.

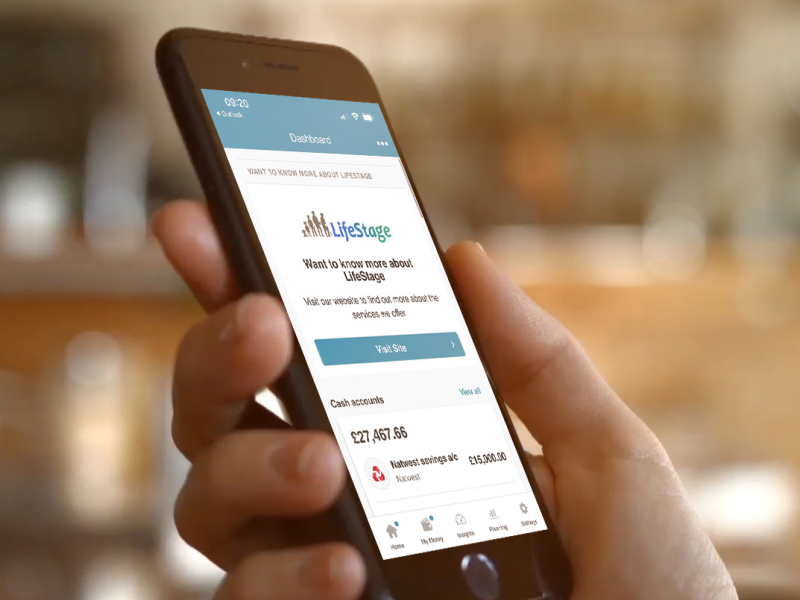

You choose the access level, and your employees access those services through our dedicated mobile app:

Each package comes with increasing levels of functionality and service. And of course, value to your employees.

Your employees will have:

- A financial dashboard

- Retirement modelling

- Online appointments and booking options

- Online financial guidance (guidance or advice?)

- Accessible due diligence

- Transparent charges

- Support from our partners with – personal legal services, long-term care support, general insurance, state benefit entitlement, debt management, workplace finance

Setting up access for your workforce is easy…

Once you’ve purchased LifeStage for your workforce, you set the access levels to the app.

We’ll then send our new users ad welcome email where they can login for the first time using their unique user ID and set their password.

In the app they can complete their profile, have immediate access to the content and resources as well as book appointments with wider support services.

Why invest in financial wellbeing for your workforce?

The biggest cause of stress outside of work is financial worries – cited by a staggering 37% as their biggest worry.

Stress impacts productivity, and the bottom line of your business.

So does turnover. The average turnover in staff in the UK is 15.6% (Monster 2022). The cost of replacing an employee is 6-9 months salary. Satisfied staff reduce turnover numbers and save you money.

This is a win-win investment for your staff and your business.